Convert 529 Plan To Roth Ira 2024. Starting in 2024, you can roll unused 529 plan funds to a roth individual retirement account, without taxes or penalties. Here's what you need to know.

It introduced two new rules relating to 529 plans and student debt that will take effect in 2024. There are limits to how much of the 529 funds you can rollover into a roth ira.

Can You Transfer A 529 To A Roth Ira?

In december 2022, congress passed the secure 2.0 act.

Starting In 2024, You Can Roll Unused 529 Plan Funds To A Roth Individual Retirement Account, Without Taxes Or Penalties.

As of 2024, the following rules apply.

Convert 529 Plan To Roth Ira 2024 Images References :

Source: www.financialsamurai.com

Source: www.financialsamurai.com

What To Do With Leftover Money In A 529 Plan?, You can transfer that cash to a roth ira. 529 education savings plan beneficiaries can transfer unused 529 funds to a roth ira.

Source: www.youtube.com

Source: www.youtube.com

EP 163 Convert 529 Plan to Roth IRA YouTube, You'll even avoid federal income tax and, in most. Starting in 2024, you can roll unused 529 plan funds to a roth individual retirement account, without taxes or penalties.

Source: fontanafinancialplanning.com

Source: fontanafinancialplanning.com

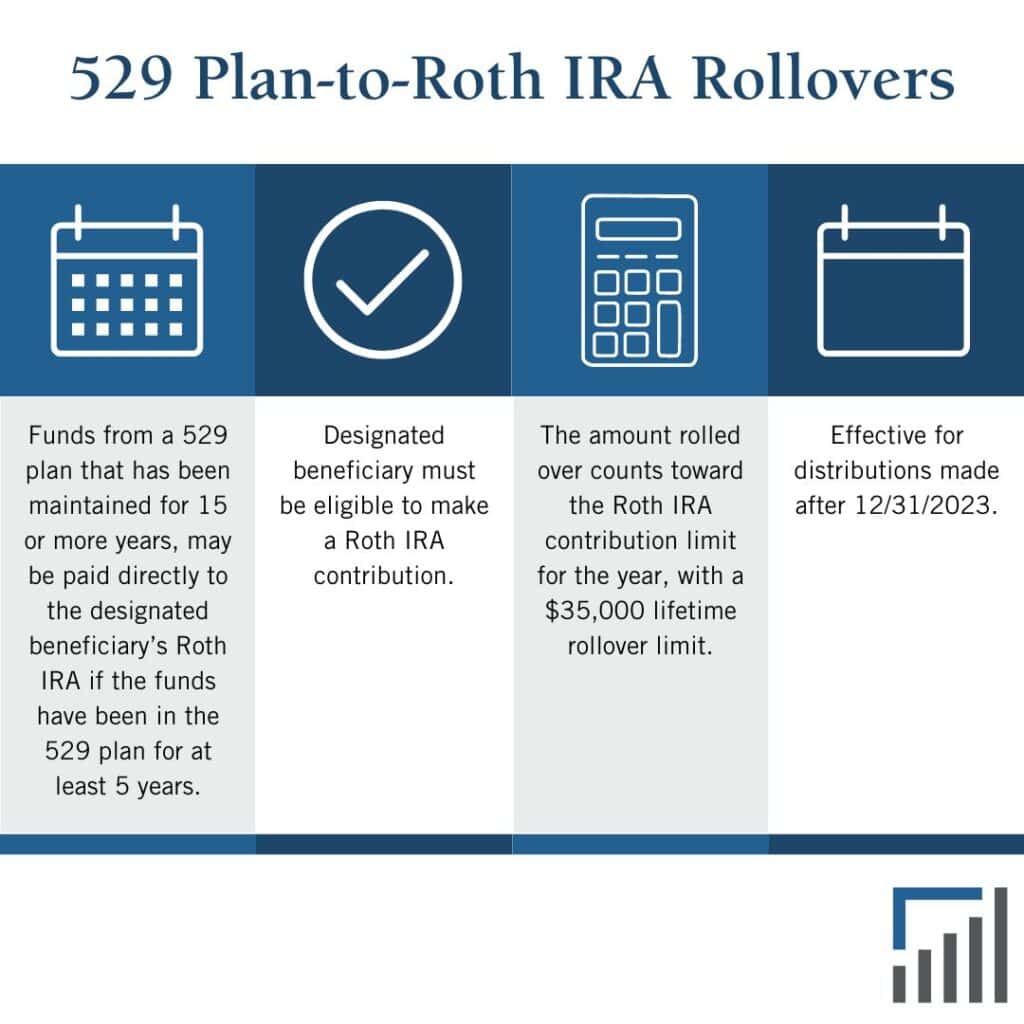

Utilizing the 529 to Roth IRA Transfer Rule Fontana Financial Planning, This can save you on taxes in the long run. Starting in 2024, you can roll unused 529 assets—up to a lifetime limit of $35,000—into the account beneficiary's roth ira, without incurring the usual 10% penalty for nonqualified withdrawals or generating any taxable income.

Source: crewe.com

Source: crewe.com

529 Rollover to Roth IRA, However, your account must meet a few requirements to roll funds over without paying federal taxes or facing penalty fees. You might know you can roll, transfer, or otherwise convert 529 assets into a roth ira account, but how do you actually do it?

Source: www.lptrust.com

Source: www.lptrust.com

Understanding 529 PlantoRoth IRA Rollovers in 2024, It introduced two new rules relating to 529 plans and student debt that will take effect in 2024. In december 2022, congress passed the secure 2.0 act.

Source: www.youtube.com

Source: www.youtube.com

Can you convert a 529 to a Roth IRA? YouTube, 529 plan beneficiaries can roll over up to $35,000 to a roth ira over their lifetime. This article explains what advisers need to know.

Source: lesyaqmichaela.pages.dev

Source: lesyaqmichaela.pages.dev

529 Limits 2024 Elset Horatia, Under the new law, beginning in 2024, you can withdraw funds from an existing 529 plan and roll them into a roth ira. While this is a great benefit, there are a number of rules you’ll need to follow to avoid taxes and penalties.

Source: www.annuityexpertadvice.com

Source: www.annuityexpertadvice.com

529 vs. Roth IRA The Annuity Expert, It allows savers to roll unused 529 funds to a roth ira without tax penalty. It introduced two new rules relating to 529 plans and student debt that will take effect in 2024.

Source: www.financialcraftsmen.com

Source: www.financialcraftsmen.com

Coming In 2024 New 529 PlanToRoth IRA Rollover Option, It introduced two new rules relating to 529 plans and student debt that will take effect in 2024. However, your account must meet a few requirements to roll funds over without paying federal taxes or facing penalty fees.

Source: www.youtube.com

Source: www.youtube.com

New 529 Plan to Roth IRA Rollover A Powerful New SECURE Act 2.0, We walk through the process step by step. You can transfer that cash to a roth ira.

Here's What You Need To Know.

You might know you can roll, transfer, or otherwise convert 529 assets into a roth ira account, but how do you actually do it?

It Introduced Two New Rules Relating To 529 Plans And Student Debt That Will Take Effect In 2024.

However, your account must meet a few requirements to roll funds over without paying federal taxes or facing penalty fees.

Category: 2024